Decentralized real estate exchanges are reshaping traditional property markets. Using blockchain technology, they’re distributing control and property ownership across a wider network of investors. There’s a lot to learn so let’s jump right in!

As we talked about in a post looking at upcoming trends in real estate, smart contracts and the blockchains they live on will certainly play a bigger role. Blockchain’s decentralization ensures no single party manipulates information and elevates security to another level. Of course, as with any innovation, challenges exist. However, understanding these nuances could unveil a new vista of opportunities in property investing.

Key Takeaways

- Decentralized real estate exchanges use blockchain technology to democratize property ownership and enhance security and transparency.

- Properties are divided into digital tokens that represent shares, making real estate investment easily accessible for anyone.

- Blockchain’s role includes automating transactions and providing a clear and immutable record of property history.

- Tokenization increases liquidity in real estate by allowing fractional ownership, opening up investment in high-value commercial properties to a broader audience.

- Despite opportunities, blockchain in real estate could pose challenges in terms of complexity, regulatory issues, market volatility, and potential fraudulent activities.

What Are Decentralized Real Estate Exchanges?

Decentralized real estate is transforming the traditional property market structure by distributing control and ownership across a broad network of investors. This innovative approach breaks down barriers, allowing even those with modest means to participate in property investment.

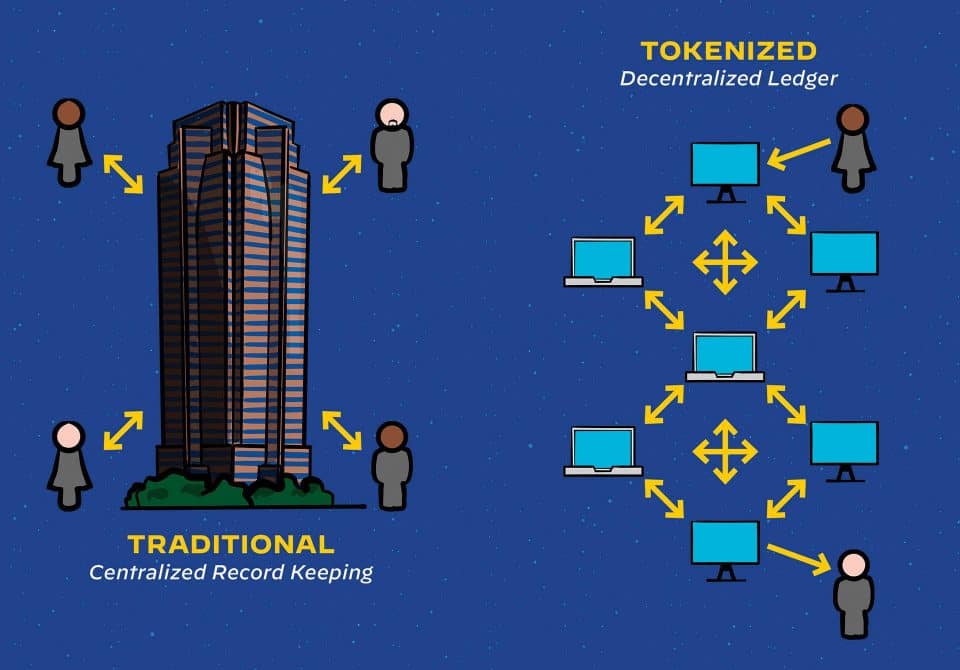

In traditional real estate transactions, large amounts of capital are required, making it inaccessible for the average individual. Decentralized real estate exchanges modify this paradigm by tokenizing property.

This means each property is divided into digital tokens, each representing a share. These tokens can be bought and sold, offering a new level of accessibility and liquidity to the real estate market.

Moreover, decentralized real estate isn’t just about buying and selling. It’s also about transparency and trust. Every transaction is recorded on the blockchain, providing a clear and immutable history of property ownership. This transparency helps reduce fraud and builds trust among investors.

Lastly, the decentralized nature of this setup allows for direct interaction between buyers and sellers, eliminating the need for intermediaries. This makes transactions faster, more efficient, and less costly.

Blockchain’s Role in Real Estate

Blockchain is used in the real estate industry to digitize records and automate transactions, streamlining the process of buying and selling properties.

Transforming Transactions

Using smart contracts, blockchain eliminates the need for intermediaries, such as brokers and lawyers. This speeds up transactions and reduces associated costs, making real estate more accessible to a broader range of investors.

Enhancing Security

The use of decentralized ledgers in blockchain technology offers unparalleled security. Each transaction is recorded and verified across multiple nodes, making it virtually impossible to alter or forge records. This significantly reduces the risk of fraud, a pressing concern in traditional real estate markets.

Increasing Transparency

Blockchain provides a transparent and immutable record of all transactions. This ensures that all parties involved have access to the same information, fostering trust and enabling more informed decision-making.

Blockchain’s role in decentralized real estate exchanges marks a significant shift from traditional property markets, promising a more efficient, secure, and transparent future.

Opportunities in Decentralized Property Markets

With the rise of blockchain technology, a wealth of opportunities has emerged in the property market, revolutionizing the way real estate is bought, sold, and managed.

- Increased Accessibility: Blockchain allows for the tokenization of real estate assets, where properties are divided into digital shares. This process lowers investment barriers, enabling more people to participate in property markets.

- Enhanced Liquidity: Tokenization also increases liquidity in real estate by allowing for fractional ownership. This concept enables investors to buy and sell portions of properties, making real estate investments more manageable and less capital-intensive.

- Efficiency and Transparency: Blockchain technology automates transactions and provides a transparent, immutable record of property history. This feature enhances trust among investors and reduces instances of fraud.

Decentralized property markets aren’t only democratizing real estate investment but also opening up new avenues for growth and innovation. As blockchain technology continues to evolve, so will the opportunities within property markets.

While blockchain is an exciting development in real estate, potential investors must understand these risks and approach with caution. This new technology isn’t a magic bullet and requires careful and informed participation.

Accessing Commercial Real Estate

Tokenization opens up new avenues by dividing commercial properties into smaller, more manageable portions for retail investors. This process, known as fractionalization, allows anyone with capital to invest in high-value commercial properties.

Consider platforms like SliceSpace that divide each listing into a million slices, making them affordable even for small-scale investors. It’s a significant shift from the past when commercial real estate was out of reach for many due to its high entry barriers.

Moreover, the rental payments from these properties are distributed daily through blockchain networks, ensuring a steady income for investors.

Through tokenization and fractionalization, commercial real estate is no longer a playground exclusively for large-scale institutional investors. Now, retail investors are also getting their fair share of the pie.

As this trend continues, it’s likely to democratize the property market, making it more accessible and equitable for all.

Risks Associated With Blockchain in Real Estate

Despite the promising opportunities offered by blockchain in real estate, it’s equally important to shed light on associated risks that can pose significant challenges.

One major concern is the complexity of blockchain technology itself. For many, it’s a new frontier with a steep learning curve. This unfamiliarity can lead to errors, misunderstandings, and potential misuse.

The decentralized nature of blockchain also raises the issue of regulatory compliance. It’s often a tangled web of local, national, and international laws that can be difficult to navigate. Without clear regulations in place, legal disputes could arise, posing a significant risk to investors.

Furthermore, the volatility associated with blockchain, most notably in cryptocurrencies, can extend to real estate transactions as well. The value of property could fluctuate wildly, making investments riskier.

Finally, while blockchain may improve transparency, it’s not immune to fraudulent activities. Sophisticated hackers could potentially manipulate the system, leading to significant losses for investors.

Final Thoughts

Decentralized real estate exchanges, powered by blockchain, are set to disrupt traditional property markets. This innovative approach can democratize ownership, enhance transaction security, and improve investment accessibility.

However, it’s not without challenges. As we navigate this new era, it’s vital to harness the opportunities while mitigating risks. Whether you’re an investor or a seasoned professional, staying informed is key to thriving in this rapidly evolving landscape.